GiPA Truck Programme 2025: what the data really tells us about Europe’s truck aftermarket Categories: 2025, 2025, News Timelines: Argentina, Brazil, Central America, Chile, China, Colombia, France, Germany, India, Italy, Mexico, Morocco, Peru, Poland, Portugal, South Africa, Spain, Thailand, Turkey, United Kingdom, Vietnam

Announcement Date : 30 November 2025

GiPA Truck Programme 2025: what the data really tells us about Europe’s truck aftermarket

According to the latest findings from GiPA’s Truck Programme 2025, the European aftermarket truck ecosystem is facing structural shifts that will redefine transport, maintenance, and repair strategies for the decade ahead.

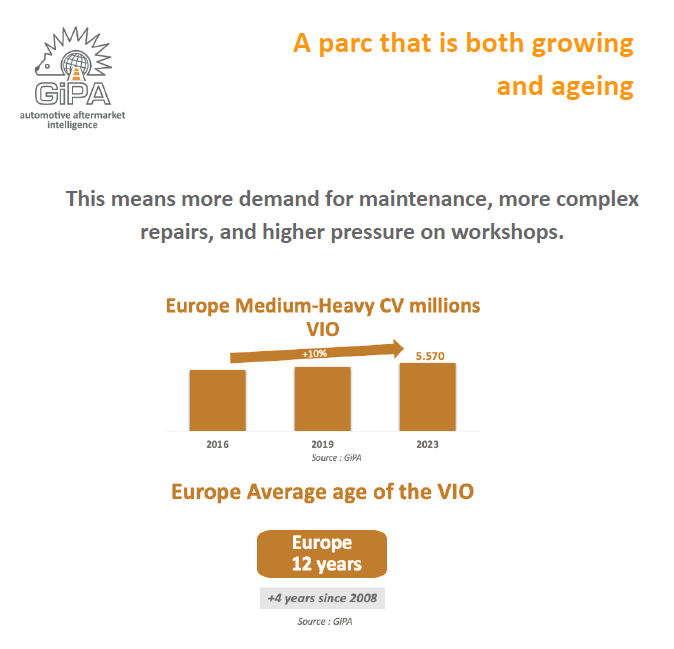

A Parc that is growing and ageing faster than expected

The European medium–heavy commercial vehicle parc has grown +10% between 2019 and 2023, reaching 5.57 million vehicles.

At the same time, the average vehicle age has climbed to 12 years, a full +4 years compared to 2008.

An ageing parc means:

- Increasing maintenance frequency

- More complex and costly repairs

- Higher pressure on workshops

- Rising demand for skilled technicians

This alone is reshaping demand patterns for both IAM and OEM networks.

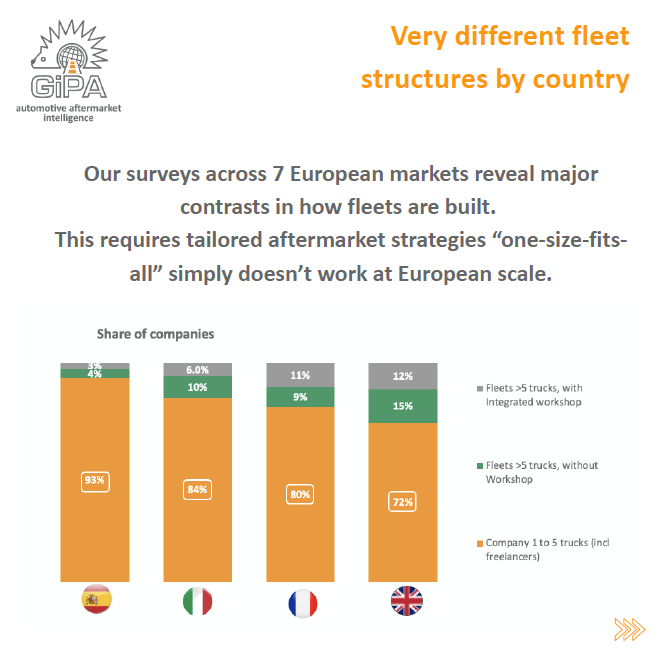

Europe fleets look radically different across countries

- In Spain, 93% of companies operate just 1–5 trucks, often independent owner–drivers.

- In Italy and France, medium-to-large fleets represent a bigger share, but workshops integrated within fleets remain a minority.

- The UK shows the most balanced fleet composition, with up to 27% of fleets operating more than 5 trucks.

The takeaway is clear: a “one-size-fits-all” strategy cannot work across Europe.

Manufacturers, distributors, and service networks must adapt their offer and coverage to local fleet realities

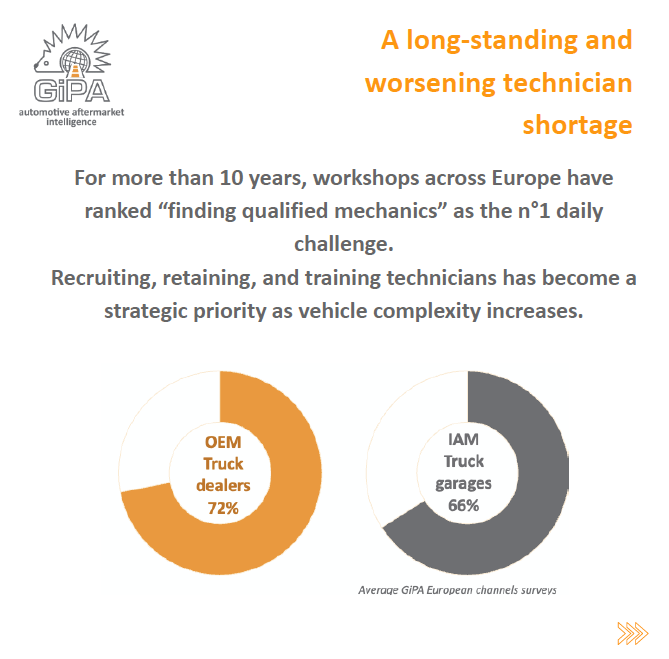

The technician crisis: Europe’s most persistent pain point

For more than a decade, finding qualified mechanics has been the #1 operational challenge and the problem continues to worsen.

According to GiPA’s data:

- 72% of OEM truck dealers say recruiting mechanics is their top difficulty.

- 66% of IAM truck garages report the same.

As vehicle technology evolves (emissions systems, advanced electronics, connectivity, EVs/alternative fuels), the skills gap becomes even more critical.

Workshops that invest in training, retention, and technology adoption will lead the next cycle.

The GiPA Truck study is one of the most robust intelligence programmes in Europe, covering 7 countries: France, Germany, Italy, Spain, UK, Portugal, Poland, thousands of interviews every year with transport companies and repairers and parallel surveys with both fleets and channels, tracked annually since 2011

This makes GiPA the only player able to map:

- Fleet behaviour

- Workshop strategies

- Parts and service demand

- Market evolution over time

- Country-by-country differences with statistically solid depth

Those who understand these shifts today will shape the landscape tomorrow.

If you want to explore the full Heavy-Duty & LCV Study or discuss how these findings impact your strategy, contact GiPA at [email protected]